Storm Damage. Insurance Disputes. We Handle It.

We document the real damage, build the claim package, fight for full scope, and deliver the actual repair. Carriers don’t get to decide what your property is worth — facts do.

AG ClaimsWorks • Claim Performance

Each bar represents a completed insurance claim. The blue column shows the initial carrier offer. The gold column shows the approved supplement value we secured through AG ClaimsWorks.

Why this matters

Insurance carriers almost never write the full job on the first scope. They leave off code items, tear-off labor, ventilation, decking issues, gutters, paint, fencing, all of it.

Our job is to document the real damage, build the proof, and force the carrier to pay what it actually takes to restore the property — not just patch it.

The chart above shows the difference between what was first offered vs. what was finally approved. That difference is the money that lets the roof actually get done right.

- ✅ We work directly with your carrier’s adjuster so you don’t have to argue.

- ✅ We cite code and manufacturer requirements so they can’t ignore it.

- ✅ We verify measurements, waste, ventilation, decking, everything.

- ✅ We manage roofing, gutters, fence, paint, stain, and cleanup as one package.

- ✅ We don’t disappear after install — you get final photos and warranty docs.

Who we’re built for

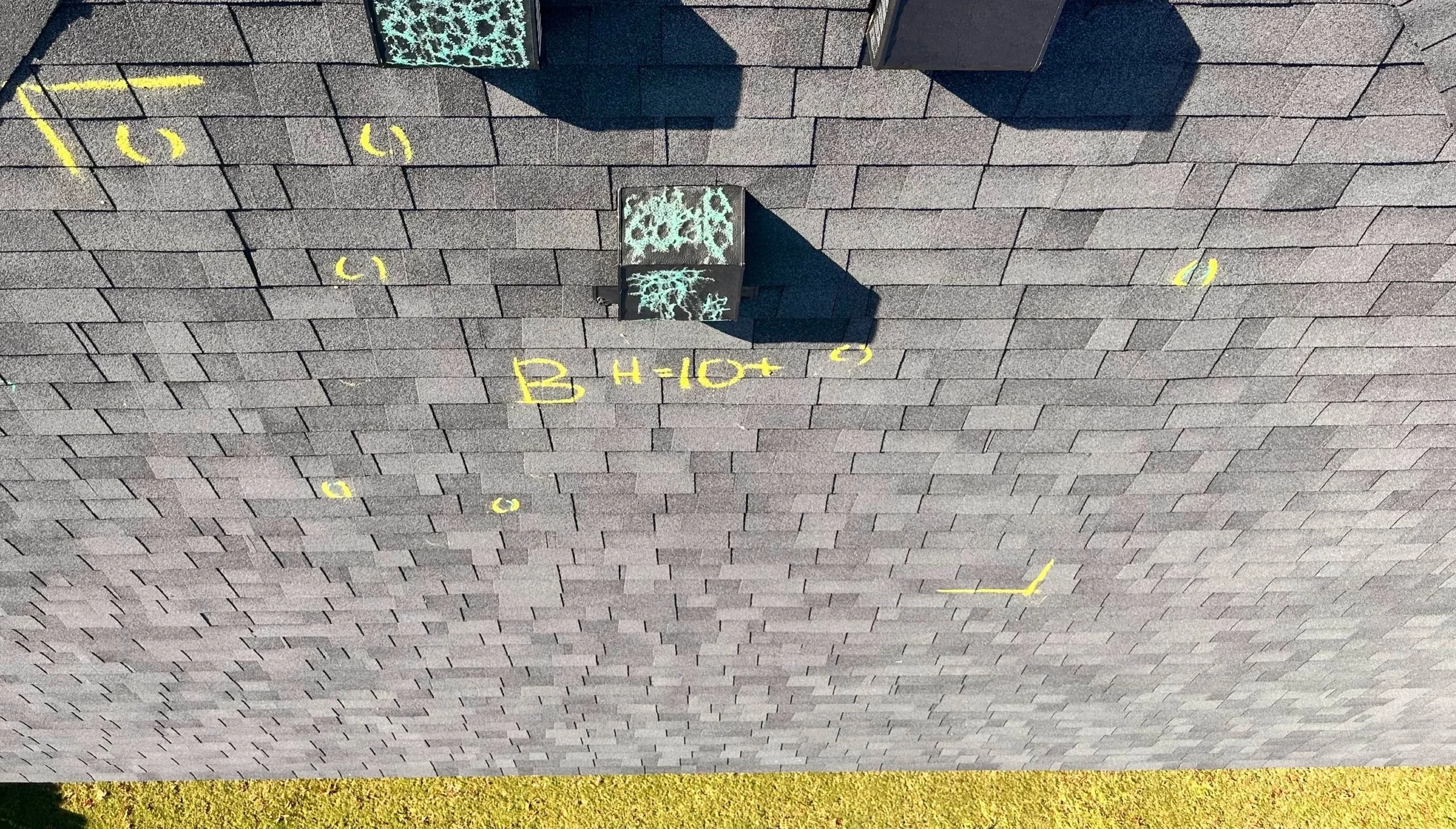

Documented Damage = Approved Scope

From inspection to installation — every photo here represents proof, process, and performance. This is how Above Ground Roofing and AG ClaimsWorks turn denied or underpaid claims into completed projects.